By Tamara Mast Henderson

Singapore’s leadership changed on May 15. The growth outlook and risks will not. The transfer of power is part of a long-planned succession, ending Prime Minister Lee Hsien Loong’s 20 years in office. Lawrence Wong, the former Deputy Prime Minister and Minister for Finance, has inherited not only a plate full of challenges — but also well-oiled government machinery to tackle them. He is likely to continue, and expand upon, existing policy initiatives rather than chart a new course.

The small, open economy faces external and domestic challenges over the medium- to long term. Topping the list are de-globalization, global warming, population aging, and the higher cost of living.

Singapore Long Term Growth Outlook

The government’s ample cushion of savings will provide Wong’s administration the resources to manage any shocks to the economy. Its well-established practice of acting strategically, guided by a thoughtful long-term plan, means Wong will have a clear road map to follow.

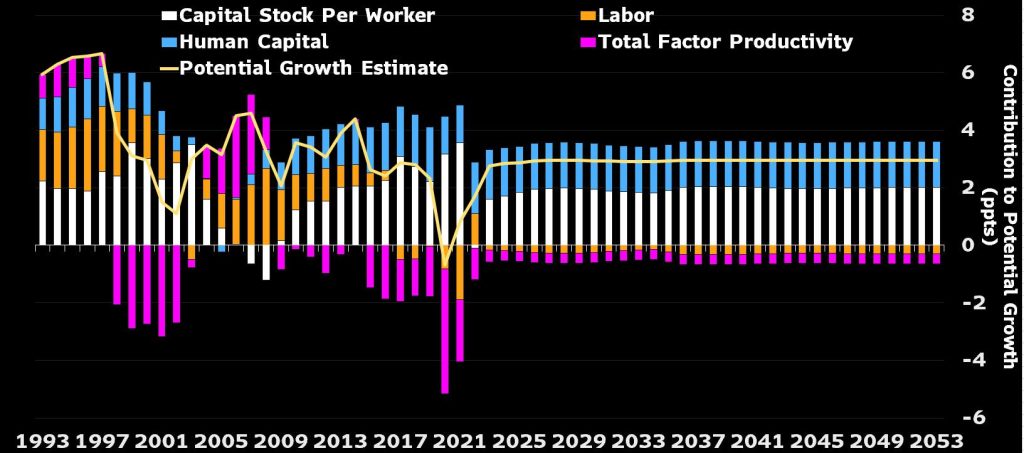

The near-term outlook for growth is clouded by a shaky global economy. We expect the economy to grow 0.8% this year, less than the Monetary Authority of Singapore’s forecast of 1%-3% reflecting our view that the slowdown in overseas demand will deepen around mid-year. Looking further ahead, we see growth accelerating to 1.8% in 2025, with long-term potential capped just below 3%, absent major external shocks.

The biggest risks to this city-state’s economy in the years ahead are likely to be external – de-globalization and global warming. These forces will inhibit growth by increasing costs, damping aggregate demand, and curbing productivity- enhancing investment. The only question in our view is the extent of the drag.

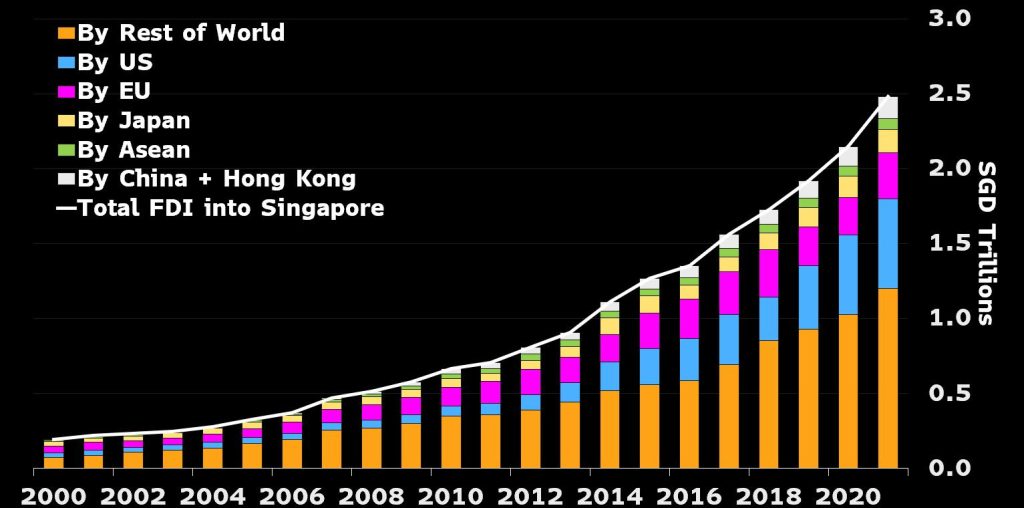

A pickup in re-shoring and near-shoring of production — by US or other multinational corporations — could make it more difficult for Singapore to attract foreign direct investment and maintain a current account surplus that’s as wide as it has been in the past.

Former US President Donald Trump plans to impose a 10% tariff on all US imports if re-elected in November. That would divert FDI to the US. Even if this threat is avoided, increased geopolitical tensions – a byproduct of de- globalization – could reinforce the re-shoring trend.

Singapore may be better-placed to retain much of its FDI appeal, especially as the government continues to reorient the economy and increase competitiveness. The government is now shepherding the city-state’s transformation into a technology and innovation hub.

What’s more, as a major security partner of the US – alongside its strategic location and high-tech economy – Singapore may be increasingly tapped as a safe-haven by both public and private-sector entities.

Meantime, the threat from rising sea levels substantially increases Singapore’s infrastructure needs. The government is already starting to set aside funds for climate mitigation and adaptation measures, which it estimates will cost US$100 billion.

Climate defense measures will divert significant resources to productivity-maintaining projects, at the expense of those that would otherwise enhance productivity and lift growth potential. That’s not just for Singapore, but also its major trading partners.

Foreign Direct Investment

The main domestic risks stem from the rising cost of living and population aging, which have scope to increase income inequality and impede social harmony. These factors are also a global phenomenon, thus posing a double threat to Singapore’s economy. The government is already working to mitigate these issues. Its intention is to leave no citizen behind so that all can aspire to have a better life.

The government is using transfer payments to help vulnerable households cope with the higher cost of living. Taxes on property, income and luxury goods have been made more progressive.

The government has put in place wage measures to support the livelihoods of those working in lower-income sectors, while taking care not to hurt competitiveness.

The government is working to raise the skill level of the workforce and assist older workers attain new skills so citizens can access higher value added jobs in today’s technology-driven global economy. This is on top of ongoing support from subsidized housing and a world-class public education system.

It makes periodic adjustments to the stamp duty for home purchases to keep houses within reach of its citizens, while at the same time not detracting from the scope for homeowners to reap a capital gain.

To ensure fiscal discipline is maintained, the government has bolstered revenue measures to meet its rising expenditure needs (especially for healthcare) as the population ages. Employees can work longer, if they choose. The retirement age has been increased, and there are training programs to help older workers keep their skills up-to-date.

Most governments will have to contend with the fallout of de-globalization, global warming, higher costs and aging societies. Singapore’s government has some advantages that could help Wong’s administration navigate these challenges.

Its institutions are well-versed at planning ahead and delivering results. The government that Wong will shepherd has already successfully navigated a barrage of material external threats — including most recently the Covid-19 pandemic, which he oversaw as co-chair of a multi-ministry taskforce.

Singapore’s success has hinged, in part, on its ability to continue to evolve and to diversify its economy. This has allowed it to maintain an attractive business climate that continues to lure FDI and produce exports of goods and services that the global consumer demands.

Singapore’s accumulated reserves generate investment earnings, a portion of which already accounts for about one fifth of the government’s annual budget. The savings cushion can also be tapped to mitigate major shocks, as was done during the Covid-19 pandemic.

Its large savings will be an even greater asset in the years ahead – and a positive differentiator for foreign investors — if global interest rates remain elevated. Other governments will be squeezed by larger debt-service burdens in the wake of the pandemic. – Bloomberg