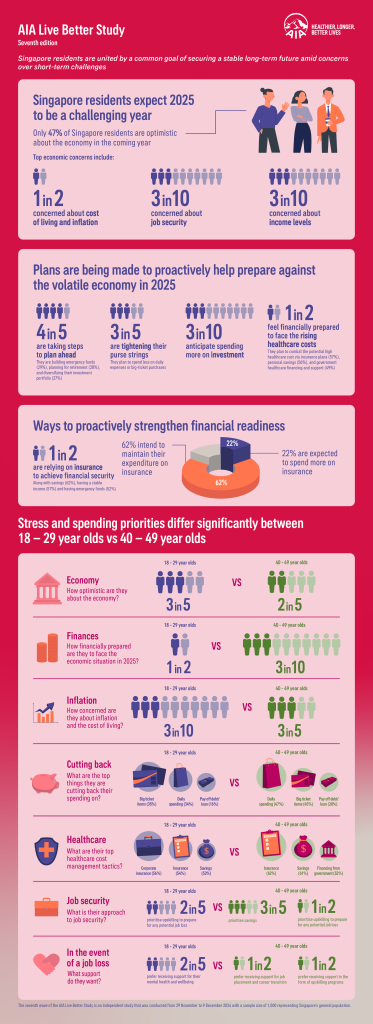

AIA Singapore’s seventh AIA Live Better Study reveals that 83% of Singapore residents plan to actively manage their finances amid concerns over a sluggish 2025 economy. The study highlights a generational divide in financial confidence—while 54% of 18-29-year-olds feel financially prepared, only 34% of 40-49-year-olds share the same sentiment, many of whom are supporting both children and elderly parents.

With only 47% of Singaporeans optimistic about the economy, top concerns include inflation and cost of living (50%), job security (35%), and income levels (34%). To boost financial resilience, residents are prioritising savings (62%), securing a stable income (57%), and setting aside emergency funds (52%).

Additionally, 48% of respondents see insurance as a key financial safety net, indicating a growing awareness of its role in long-term financial planning. More than half of respondents (59%) are also planning to cut back on daily expenses and reduce spending on big-ticket purchases.

Rising healthcare costs are another major concern, with 53% of Singaporeans perceiving medical expenses as expensive, yet only 47% feeling financially prepared to manage them. To address this, 57% are turning to insurance, while 56% are relying on personal savings and 49% on government healthcare financing.

AIA Singapore continues to offer tailored solutions that help individuals and businesses safeguard against rising medical expenses, ensuring long-term financial security.

Employment stability remains a pressing issue, particularly for those in their 40s (61%), compared to 47% of younger adults. While younger individuals prioritise upskilling (40%) to stay competitive, their older counterparts are focusing on building savings (55%) and setting aside emergency funds (46%).

There is also a shift in financial priorities between generations—while 18-29-year-olds are more focused on lifestyle experiences, those in their 40s are prioritising financial stability and reducing discretionary spending.

Despite differing approaches to financial planning, both younger and older Singaporeans share the common goal of securing a stable future in an uncertain economic climate. “AIA Singapore remains committed to empowering individuals and SMEs with comprehensive financial solutions to navigate economic challenges and build a prosperous future,” said Irma Hadikusuma, Chief Marketing and Healthcare Officer, AIA Singapore.

The company continues to support the community with insurance, investment, and financial planning tools to help Singaporeans adapt to evolving financial and healthcare needs.