Employing more than a quarter of the global workforce, agriculture accounts for 4% of global GDP, totaling nearly US$4.5 trillion. At the heart of this value chain are more than 608 million smallholder farmers who produce around a third of the world’s food.

Yet despite agricultural development being one of the most powerful tools for ending extreme poverty, farming no longer guarantees a sustainable livelihood. In fact, 65% of poor working adults make a living through agriculture.

To help tackle this problem, and as part of the company’s global effort to drive financial and digital inclusion, Mastercard announced that it would expand its Farm Pass digital platform across the Asia Pacific region, building on its early success in India.

The firm said in a statement at the Singapore FinTech Festival that the programme is on track to connect 30 million people globally, including 15 million in Asia Pacific, with its Community Pass services, of which Farm Pass is a part, over the next five years.

Agrifinance Challenges

A one-stop solution that digitizes marketplaces, payments and workflows within the agriculture sector, Farm Pass addresses both the hurdles hindering digitisation of rural communities and the economic hardships faced by farmers in many parts of the world. The former includes high rates of digital illiteracy, and significant infrastructure challenges such as a lack of (or unreliable) internet access, low rates of smartphone ownership and, in many cases, no consistent form of identification or credentials. In addition, the agricultural value chain can be highly complex, manual, and cash-based, which can lead to inefficiencies, waste, and fraud.

Compounding these systemic issues, while farmers urgently need access to credit and a bigger pool of buyers to make farming commercially sustainable, banks in places like India and Africa can struggle to serve them or underwrite credit. This is primarily due to a lack of reliable data about their incomes and expenditures, which tend to be cash-based. For farmers, this can lead to higher operating costs, including exorbitantly high-interest rates for borrowing from unofficial lenders.

“While technology has brought profound benefits to much of the world, digitally excluded people in remote communities, like most farmers, face unique challenges in breaking the cycle of poverty. Too often, smallholder farmers’ profits are at the mercy of forces outside their control, making them price takers rather than price makers,” said Ari Sarker, president, Asia Pacific, Mastercard.

“The beauty of Farm Pass is that it works by addressing farmers’ most pressing needs: to get digital, get paid and get capital, giving them greater leverage in the agricultural value chain. Importantly, Farm Pass isn’t an aid program or philanthropy—rather, it enables farmers to be properly compensated for their work by cutting out inefficiencies and middlemen, creating a commercially sustainable system for all involved.”

The Solution

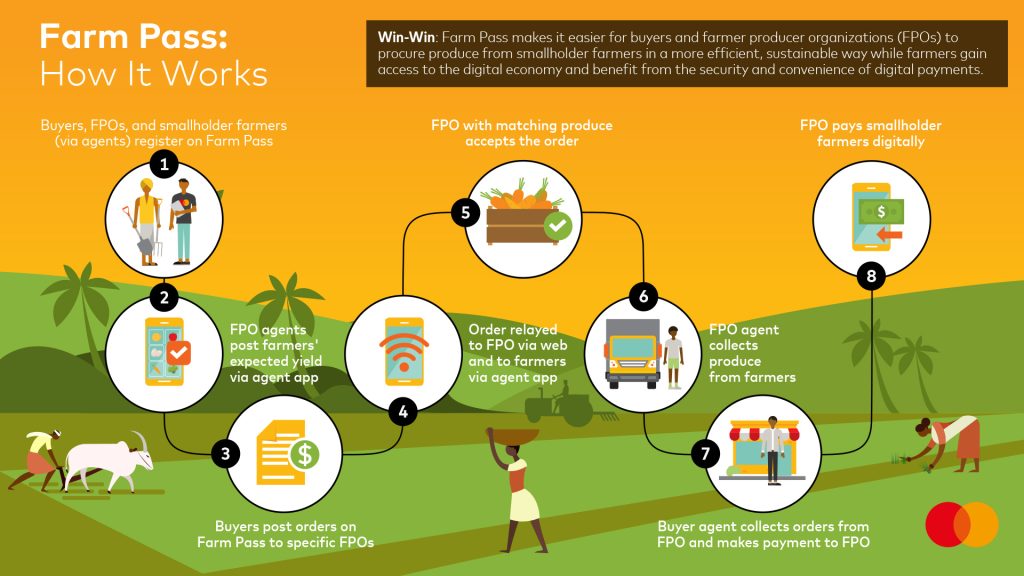

The Farm Pass operating model works by first establishing a digital identity for farmers. In turn, this allows their income, harvest data and transaction history to be digitized, enabling them to build a credit profile. By deploying a hybrid physical-digital model, ecosystem partners onboard farmers at scale and capture real-time insights, while farmers receive assistance from agents in-person, as well as digitally, contributing to effective enrolment and adoption of the program.

Most importantly, the Farm Pass ecosystem works both online and offline, enabled by internet agnostic technology and a network of agents who meet farmers in person and connect them to the platform on their behalf. This way, farmers do not need to own a smartphone, pay for data, or be digitally literate in order to participate in the program.

Once onboarded, farmers are connected digitally to a network of agricultural buyers, inputs dealers, and other agriculture players. Through the digital platform, farmers gain access to reliable markets where they can be paid fair prices, while buyers find sustainable sources of quality produce. By bringing together various agri-sector stakeholders in one agricultural marketplace, Farm Pass amplifies the net positive impact on farming communities.

Key Benefits

- Financial Inclusion: Farm Pass provides access to financial services for a customer segment (farmers) that otherwise couldn’t be reached.

- Inclusive Growth: Farmers build credit profiles and

- Higher Incomes: Farmers gain access to marketplaces and more buyers, improving their

- Convenience: Payments are disbursed digitally, reducing cost, time and effort per

- Transparency: Near real-time visibility of end-to-end value chain

- Operational Efficiencies: Reduced sourcing costs as Farm Pass aggregates produce through

- Trust & Transparency: Stronger ties between agri-sector partners and greater visibility of