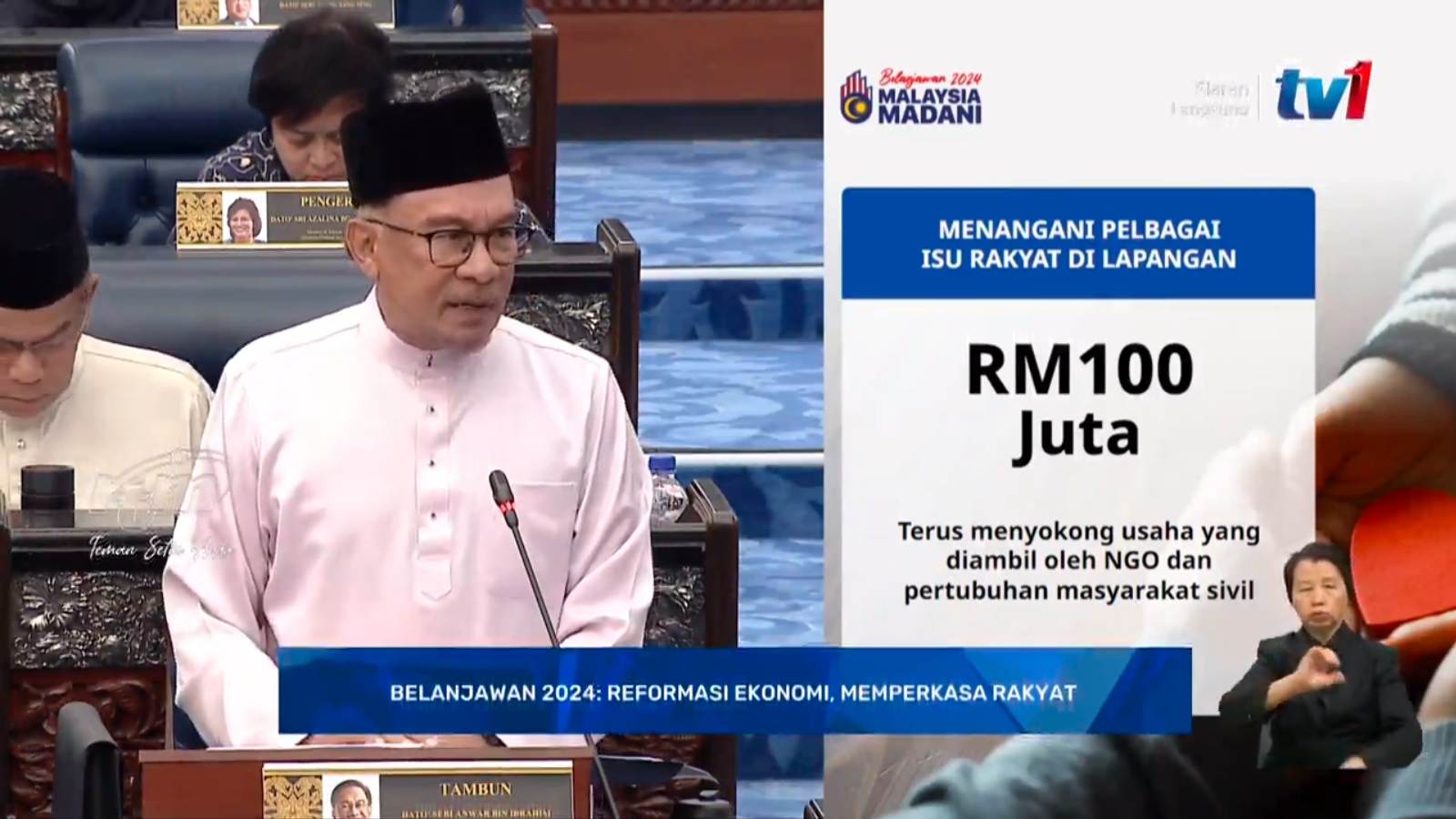

Prime minister Datuk Seri Anwar Ibrahim presented the highly anticipated Malaysia Madani 2024 Budget today, outlining a comprehensive strategy aimed at economic revitalization, fiscal prudence, and enhanced social welfare measures.

Capital Gains Tax and Tax Reforms

One of the key highlights of Budget 2024 is the introduction of a 10% capital gains tax on the disposal of non-listed local companies’ profits from March 1, 2024. Exceptions to this rule include approved Initial Public Offerings (IPOs), internal restructuring, and venture capital companies, provided certain conditions are met.

Furthermore, a global minimum tax on companies with a global income of at least €750 million will be implemented in 2025, indicating Malaysia’s commitment to international tax standards.

Electricity Rebates and Service Tax Adjustments

In a move to alleviate the burden on low-income households, the government announced rebates on electric bills, with eligible hardcore poor families receiving up to RM40 per month. Additionally, account deposit requirements for electricity bill accounts under the owner’s name will be waived.

However, the service tax is set to increase from 6% to 8%, excluding essential services like food, beverages, and telecommunications. The scope of taxable services will also expand to include logistics, brokerage, underwriting, and karaoke services. Moreover, high-value goods such as jewelry and watches will be subjected to a High-Value Goods Tax at a rate of 5% to 10%.

Subsidy, Diesel and Food Security

The government will restructure subsidies for diesel, where logistics companies and specific groups will continue to benefit from subsidised diesel prices. However, other users will face a higher price as part of the government’s effort to rationalize fuel subsidies. The current subsidy of RM1.60 per litre, which caps the price at RM2.15 per litre, will be adjusted accordingly.

Temporary price controls will be introduced to ensure a steady supply of chicken and eggs in the local market. The Agriculture and Food Security Ministry will provide specific details on these measures within the next two weeks.

Other Allocations

A substantial allocation of RM2.4 billion has been dedicated to constructing, maintaining, and repairing quarters for civil servants, teachers, hospital staff, police officers, soldiers, and firefighters. This move reflects the government’s commitment to enhancing the living conditions of essential public servants.

In addition to these allocations, the 2024 Budget earmarks a total of RM393.8 billion. This comprises RM303.8 billion for operating expenditure and RM90 billion for development expenditure, including RM2 billion in contingency savings.

Government revenues are anticipated to rise from RM303.2 billion this year to RM307.6 billion in 2024. Consequently, the fiscal deficit is expected to decrease to 4.3% in the coming year, indicating a positive economic trajectory.

In his speech, prime minister Anwar emphasised the need for collective efforts to drive Malaysia’s economic recovery. The measures outlined in the Budget 2024 not only address immediate economic challenges but also pave the way for sustainable growth and prosperity in the years to come.

As the nation moves forward, these initiatives are expected to play a vital role in shaping Malaysia’s economic landscape.

more to come