Effective 1 February 2020, Syarikat Jaminan Pembiayaan Perniagaan Berhad (SJPP) will start to accept applications to provide Government guarantee schemes to Malaysian SMEs. The schemes were launched by Finance Minister Lim Guan Eng at an event on 21 January 2020 at Shangri-La Hotel, Kuala Lumpur.

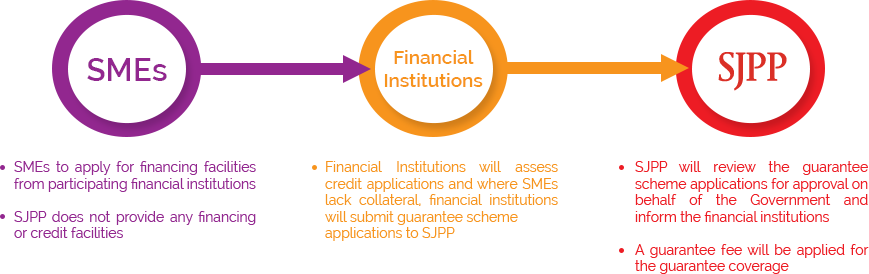

The Government guarantee schemes will be extended to SMEs via participating financial institutions. Participating financial institutions include most major banks in Malaysia, who will assess the SMEs’ guarantee scheme applications and submit them to SJPP. SJPP will then review the applications and inform the banks. SJPP itself does not provide financing facilities.

Under Budget 2020, SJPP has been mandated to administer and manage guarantee schemes targeted towards women and Bumiputera entrepreneurs, startups, as well as encouraging automation and digitalisation among SMEs.

Speaking at the event, Chen Yin Heng, Principal Officer of SJPP said, “If all related parties are to work together, then a greater synergy will result between the government, private sectors, and financial institutions into having an ecosystem that encourages innovation and entrepreneurship in Malaysia that will bring the SME sector to a higher level.”

Since its inception in 2009, SJPP has enabled RM33.5 billion worth of financing, benefiting 19,843 SMEs. Currently, SJPP has RM20.5 billion active guarantee schemes supporting the growth of SMEs.

Raymond Chui, Executive Director, Country Head, Business Banking of United Overseas Bank Malaysia said, “Since we partnered with SJPP, we’ve approved around 1500 such loans to our eligible SME customers, collectively worth around RM1.5 billion. To further help SMEs in the market, we’ve run events together with SJPP to reach out to them and let them know about this program.”

“We publicise these events to our existing customers, as well as through our Facebook page and through business associations like chambers of commerce. So far, the reception has been very good, with 50 to 100 participants attending our events. Some of our large scale events even have up to 200 participants,” added Chui.

The push towards helping SMEs is in line with the Government’s overall aim of upgrading the capacity of Malaysian SMEs and making them more competitive in the Fourth Industrial Revolution. Minister of Finance, Lim Guan Eng said, “SMEs are crucial to the health of the Malaysian economy. They constitute 98.5 percent of total business establishments in Malaysia. Approximately 38.3 percent of the Malaysian GDP was contributed by SMEs in 2018. Additionally, about 65 percent of workers in Malaysia are employed through SMEs.”

“With the official launching of the enhanced guarantee schemes, I hope SJPP can raise its performance higher and help more credible SMEs interested in upgrading themselves gain better access to financing,” added Lim.

SJPP has also recognised participating financial institutions for their achievements in approved financing and guarantee activation in the Government guarantee schemes managed by SJPP. For this, the Top Performance Award 2019 was presented to RHB Bank Berhad, United Overseas Bank Malaysia Berhad, Maybank Berhad, Bank Islam Malaysia Berhad, and Standard Chartered Bank Malaysia Berhad.

Another award category is the Special Award for Promoting Government Guarantee Schemes 2019, won by United Overseas Bank Malaysia Berhad, HSBC Bank Malaysia Berhad, SME Development Bank Malaysia Berhad, Malaysia Industrial Development Finance Berhad (MIDF), and Agrobank. This award is presented to the winners for their aggressive programs and initiatives in promoting the Government guarantee schemes together with SJPP to their SME customers.

Chui said, “It is a testimony and validation for our work in helping SMEs grow. SMEs are the backbone of Malaysia’s economy, but one of their biggest pain points is that they do not know where to obtain financing. So we are here to reach out to them, not only in the Klang Valley but also in smaller towns throughout Malaysia.”