It is inevitable that digital transformation is changing consumers’ behaviour today. For instance, we are open to shopping online compared to walking into an actual retail outlet, and we prefer to purchase items via cashless payment modes.

Like it or not, we have been impacted by some of these latest trends and it is likely that more of such trends will continue to emerge over time.

Given this development, SMEs have to re-think their business model to meet consumers’ needs or risk having their businesses playing catch up or being left out altogether. As part of efforts to support SMEs with the latest digital services, Maybank has introduced a range of solutions that can help transform their business:

a. Efficient financial management is crucial

A business account is crucial when you first set up a company. It helps to manage your finances while at the same time strengthens your credibility among suppliers and investors. The Maybank SME First Account, a business current account tailored for SMEs is supported by a robust online platform, Maybank2u Biz, which enables users to view and manage their transactions anywhere and anytime.

b. Always on the go and cost efficient

Maybank2u/Maybank2u Biz helps you to manage your account from anywhere and anytime. It is convenient, simple and user friendly as well as secured by multiple approval features via its checker and maker function. You can pay your company bills, transfer funds, perform remittance transactions and check account balances seamlessly, thanks to its various online capabilities.

For Maybank2u Biz users, the bulk payment feature enables multiple supplier payments or staff salaries to be transferred to up to 100 recipients at one go. This helps business owners to save time and cost, as they no longer need to queue at the bank or issue cheques to pay their business expenses.

c. Fast forward your business

For SMEs which are looking for additional funds to enhance their digital capabilities or for other working capital purpose, the Maybank SME Clean Loan/Financing-i provides convenience with collateral-free financing and fast approval. Eligible SMEs are able to apply for a minimum financing of RM50,000 up to RM1,500,000.

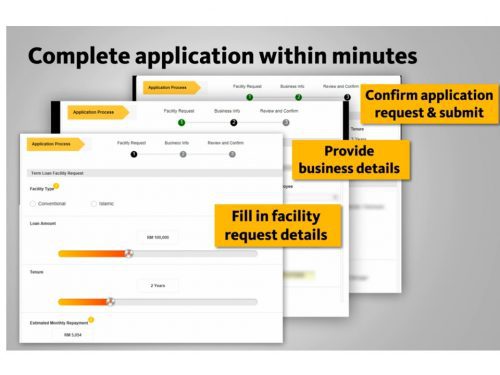

For existing Maybank customers, this facility is available online via Maybank2u Biz for financing amounts of up to RM250,000. With just three simple steps – log in to Maybank2u Biz, select desired financing amount and then submit the application – applicants can then receive notification instantly on their application status.

Apply online with these simple steps:

d. Catch digital savvy customers through Maybank QR Pay

This cashless payment gateway is specifically designed for retailers to make the entire customers’ payment journey effortless. It just takes a few simple steps to download the Maybank QRPay merchant app and register as a merchant. This platform allows you to receive payments instantly when customers scan your unique QR code.

e. Seamless payment for online business with Maybank2u Pay

We believe any online business has to provide hassle free experience for customers. Now, you can do the same with Maybank2u Pay as this payment gateway makes online payment easier for your customers on your website by debiting their Maybank account. It is secure, easy to setup and highly cost efficient.

To know more about Maybank’s customised solutions for SMEs, please visit www.maybank2u.com.my or contact 1300 80 8668.