Analysts warn of a pessimistic outlook for ASEAN economies despite mixed GDP growth in the previous quarter

According to Oxford Economics’ recent research commissioned by the Institute of Chartered Accountants in England and Wales (ICAEW), a slowdown in growth is expected to become more apparent in Q3, with ASEAN-6 nations (Malaysia, Indonesia, Philippines, Singapore, Thailand, and Vietnam) projecting around 3.6% growth in the second half of 2023, down from 4.2% in the first half and 5.7% in 2022.

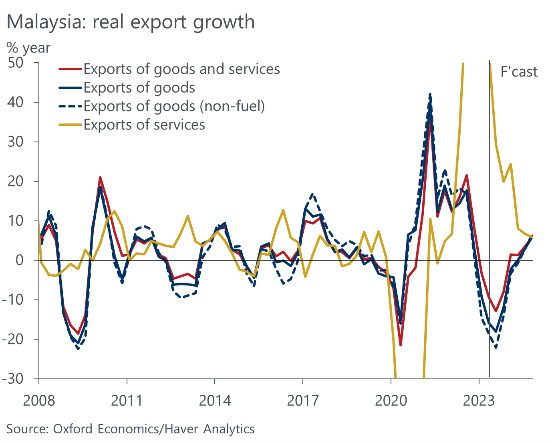

Several factors contributed to this slowdown in Q3, including the deceleration of China’s post-pandemic recovery, the impact of the U.S. Federal Reserve’s interest rate hikes, and weak semiconductor prices affecting countries like Singapore and Malaysia. Export sectors have been particularly affected, with a shift in global demand from goods to services contributing to a slowdown in export growth.

However, the domestic demand in Southeast Asian countries is also expected to weaken due to limited real wage growth and increased debt among lower-income households, especially in Thailand.

Malaysia: Positive Outlook with Moderate Growth

Malaysia’s economic outlook remains cautiously positive, with diverse economic sectors, notably tourism, showing signs of recovery and expansion. Although there was a notable GDP growth slowdown to 2.9% in Q2 y/y from 5.6% in Q1, the quarterly momentum remains robust, growing to 1.5% q/q in Q2, primarily driven by strong domestic demand and a revival in the travel sector.

Domestic demand, characterized by significant quarter-on-quarter increases in private consumption, government spending, and investment, contributes to a more stable outlook for the Malaysian economy. However, sustaining high growth rates might pose challenges due to high personal debt burdens and depleted savings among households.

The tourism sector remains a significant contributor to Malaysia’s economic landscape, with changes in visitor demographics expected to boost tourism receipts despite limited growth in tourist arrivals.

The export sector faces challenges, with falling export earnings affecting hiring and spending plans for businesses, exacerbated by a tough export environment and deteriorating economic data in China, Malaysia’s largest export partner.

Despite these challenges, Malaysia’s GDP growth is expected to reach 3% this year, following impressive 8.7% growth in 2022. Achieving the higher estimates would require exceptionally strong growth in Q3 and Q4.

Regional Inflation Trends

Headline inflation is falling across the ASEAN region, with South-East Asia’s CPI inflation forecasted at 3.5% this year, down from 4.6% in 2022, and expected to further decline to 2.4% in 2024. In response, central banks in the region are likely to have reached the peak of their rate hiking cycles, with rate cuts expected in some countries.

However, the rate-cutting timeline may be delayed due to China’s rapid slowdown, as the effectiveness of rate cuts in stimulating demand remains uncertain.

Other Regional Findings

- Singapore: The economy shrank over the first half of the year, and growth remains dependent on global demand, leading to expectations of monetary policy easing in early 2024.

- Indonesia: The export sector is expected to be a drag on the economy as global demand slows, and domestic demand may weaken due to the impact of monetary tightening, leading to policy loosening by year-end.

- Vietnam: Despite strong Q2 GDP growth, external headwinds persist due to weak global demand, with policy support expected to provide relief in the second half.

Overall, ASEAN economies face a complex mix of challenges and opportunities in the coming months, with their resilience and ability to adapt to changing global dynamics being key factors in their future growth prospects.