The banking sector in Malaysia is well-positioned to withstand shocks and supportive of financial intermediation activities as it continues to be backed by healthy capital and liquidity buffers.

According to Hong Leong Investment Bank (HLIB), risks to financial stability such as credit, market, liquidity and contagion were quite contained in the first half of 2024, with household and business segments remaining in good shape.

“Total household debt-to-gross domestic product was broadly unchanged at 83.8 percent from 84.2 percent last year, in line with the healthy economy.

“For businesses, the interest coverage ratio rose to 6.2 times (compared to 5.8 times in 2023), the debt-to-equity ratio was flat at 20.5 percent and the cash-to-short-term debt ratio remains the same at 1.4 times,” HLIB said in a note.

It added that the price run-up of banking stocks in August and the ringgit performing strongly has the potential to cause foreign investors to gain considerable currency and capital gains.

“As such, banks are susceptible to selling pressure. That said, pull-backs are healthy as it presents opportunities to buy on weakness,” it said.

Meanwhile, MIDF Research said that the strong funding and liquidity positions of banks remain supportive of intermediation activities, with overall business loan impairment ratio keeping stable at 2.6 percent of business loans.

“Looking forward, Bank Negara Malaysia expects business resilience to further improve in the second half of 2024 amid sustained expansion in economic activity,” MIDF Research said, adding that loan growth continues to be robust while asset quality remains stable.

On this, HLIB maintains its “neutral” call on the sector with the top picks being RHB Bank Bhd, AMMB Holdings Bhd and Alliance Bank Malaysia Bhd.

Additionally, MIDF Research’s preferences are Malayan Banking Bhd (Maybank) and Bank Islam Malaysia Bhd.

Digital bank further promotes SME growth

RHB Bank Bhd is also holding steady in its venture into digital banking with its 40 percent stake in Boost Bank alongside Boost Holdings Sdn Bhd that owns the remaining 60 percent.

RHB group managing director and group CEO Mohd Rashid Mohamad said that the venture aims to complement the group’s efforts to serve the unserved and underserved market segments, which might not be attractive to other conventional banks.

“Bank Negara (was) very clear about who these digital banks are going to be serving – the underserved and unserved. (With this) joint venture, it’s more about complementing than competing with our larger scale of business,” he said, adding that RHB will also continue to improve its digitalisation efforts on the conventional banking side.

He also said that digital banks tend to be exposed to more risk compared to incumbent banks, using RHB’s #JomBiz programme as an example.

“These are micro, small and medium enterprises (MSMEs) that are not bankable to us, but they will naturally go to the digital bank. Similarly, as part of a cross-referral arrangement, if there is anything big that comes to the digital bank, it will be referred to us (RHB),” Rashid explained.

It has been reported that Boost Bank is set to launch its SME Financing services in October, featuring Term Loan and Revolving Credit to drive financial empowerment and inclusivity for both SMEs and MSMEs in Malaysia.

The service will allow for fast loan processing and is designed to provide flexible financial solutions that cater to the diverse needs of Malaysian SMEs. The bank also plans to hold a series of roadshows across East Malaysia to educate users on healthier saving habits.

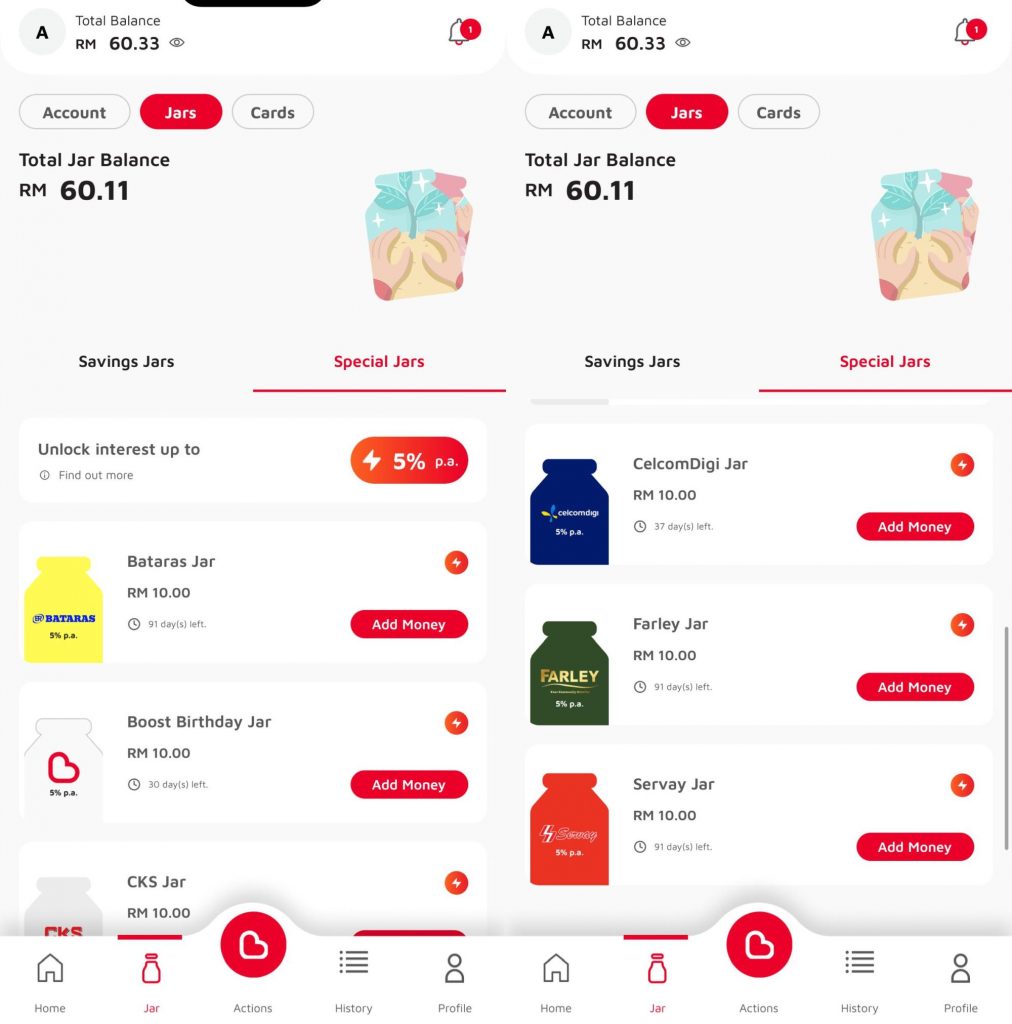

Additionally, the digital bank recently announced its latest product offering of earning a 5 percent per annum (p.a.) daily interest rate on savings deposited in its “Boost Birthday Jar” throughout October.

Currently, customers can deposit money into their Boost Bank account at a 2.5 percent p.a. daily interest and the earned interest will be credited into their accounts on a weekly basis. For long term savings, its Saving Jar offers 3.6 percent p.a. daily interest.

With the new product, Boost Bank grants a 5 percent p.a. daily interest via the 6 Special Jars, namely Boost Birthday, CelcomDigi, Bataras, CKS, Farley and Servay.

To date, Boost Bank has over 2 million merchants onboarded across Malaysia.