Antler, the global early-stage venture capital firm, has affirmed its commitment to backing exceptional founders, closing 96 deals worth over US$12.5 million across Southeast Asia in 2024 despite challenging market conditions, maintaining a steady investment pace comparable to 104 deals in 2023, worth over US$12.6 million.

This brings the firm’s total investments across the region to 200 deals worth US$25 million over the past two years.

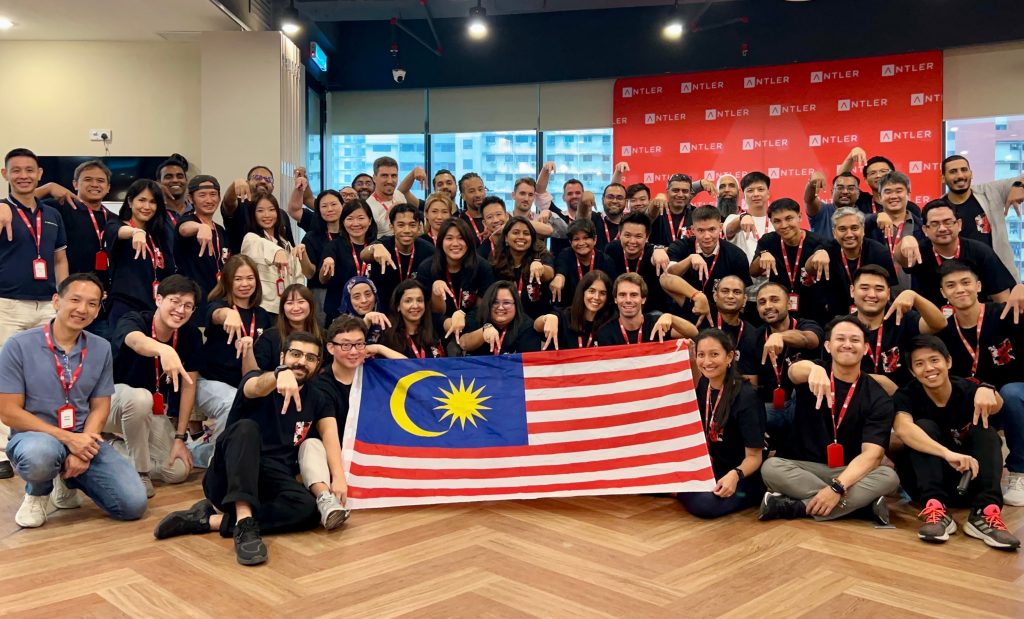

Having recently expanded to Malaysia in 2023, Antler has deployed US$1.3 million across 12 early-stage investments in this region this year, marking a strong investment momentum following seven investments worth US$770,000 in 2023. This brings the firm’s total investments in Malaysia to 19 deals worth US$2 million over the past year and a half.

The firm’s Southeast Asian portfolio companies have demonstrated remarkable resilience since Antler’s inception, collectively securing more than US$350 million in follow-on funding, underlining the strength of its investment thesis and founder selection.

The firm’s sustained investment activity comes amid a significant contraction in Southeast Asia’s funding landscape. According to Tracxn’s latest report, the region’s tech funding plunged 59 percent year-on-year to US$2.84 billion in 2024, marking an 80 percent decline from US$14.2 billion in 2022.

Despite this challenging environment, Antler has maintained its commitment to early-stage investing as identifying and backing founders who demonstrate strong fundamentals early in their journey has proven more critical than ever.

Building on this momentum, Antler will aim to deploy US$20 million across Southeast Asia, including Malaysia, in the first half of 2025, reinforcing its position as a key catalyst in the startup ecosystem.

As the earliest institutional investors in the region, Antler’s initial capital, global platform, and network of advisors and investors have been instrumental in helping founders build companies that now form a significant part of Southeast Asia’s technology landscape.

To further strengthen its support for founders from inception through growth, Antler continues to offer its recently introduced ARC (Agreement for Rolling Capital) initiative. This funding structure enables early-stage founders to secure up to US$600,000, including initial investment, pro-rata follow-on, and ARC, within the first six to nine months of a company’s lifecycle.

Crunchbase has previously indicated a notable shift in investor focus toward early-stage opportunities, with deal volumes showing greater resilience compared to later stages. This trend has been particularly pronounced in Southeast Asia, where digital adoption continues to accelerate across key markets.

Antler’s portfolio has shown strong traction across various sectors, from enterprise software to fintech, sustainability, and next-gen consumer technology. As AI in particular continues to reshape the technology landscape, Antler has observed a surge in founders leveraging it across various industries.

Jussi Salovaara, Co-founder and Managing Partner of Antler, commented, “We believe the best companies are built in the toughest markets. While others might see uncertainty, we see opportunity. The current market environment has created ideal conditions for building sustainable, capital-efficient businesses.

“Founders today are more focused on fundamentals and solving real problems, which aligns perfectly with our investment thesis. As we look ahead, we believe the greatest challenge won’t be technological—it will be societal.

“The gap between AI-enabled organizations and those who fail to adapt will widen dramatically. Success won’t just come from having the best AI, but from deeply understanding how to apply it to real problems. This is why we’re particularly excited about vertical AI applications, where founders combine domain expertise with AI capabilities to solve specific industry challenges.”

According to CB Insights, early-stage investments in AI-enabled startups have shown particular resilience, with deal volumes remaining steady despite broader market fluctuations. Antler’s portfolio reflects this trend, with an increasing number of founders integrating AI capabilities into their core solutions.

Founded on the belief that people innovating is key to building a better future, Antler has invested in more than 1,400 startups across six continents, with notable Southeast Asian investments including global e-SIM marketplace Airalo, platform for refurbished electronic devices Reebelo, smart point-of-sale system provider Qashier, AI-driven financial data automation platform fileAI, and modern expense management solution Volopay.

With offices in this region including Singapore, Jakarta, Ho Chi Minh, and Kuala Lumpur, Antler is actively seeking exceptional individuals and early-stage startups to support from day zero through every stage of their growth journey.