The year kicked off on a cautiously optimistic note, marked by a selective thaw following a quieter period. The Americas and EMEIA IPO markets had a bright start in 2024, increasing global proceeds. However, the Asia-Pacific region started on a weak note, weighing down the overall global volume.

For Q1 2024, the global IPO market saw 287 deals raising US$23.7 billion, a 7% decrease in volume but a 7% increase in proceeds year-over-year (YOY), respectively. These and other findings are available in the EY Global IPO Trends Q1 2024.

In Q1 2024, a majority of key IPO markets witnessed a significant number of newly issued IPOs whose current share prices surpassed their offer prices. This trend could indicate an improvement in valuations and pricing levels, reflecting growing confidence among issuers and investors.

An IPO is one of the pinnacle achievements for private equity (PE) firms, serving as a public showcase of their acumen and a defining milestone in their growth journey. In Q1 2024, approximately 10 PE-backed IPOs came to the market, five of which were featured among the top 10 global IPOs, a testament to their significant market presence.

The promise and reach of the artificial intelligence (AI) vertical is currently experiencing significant growth within the private realm, with the majority of AI and AI-associated businesses still in the seed or early stage of venture capital (VC) rounds. This suggests there could be a surge in IPOs in future years as these companies mature in the private domain before making a public debut.

Americas and EMEIA recovering; Asia-Pacific plunging

The global IPO market has experienced significant shifts in geographical composition, driven by ongoing macroeconomic and geopolitical dynamics.

The Americas continued to exhibit strong performance in IPO activity compared with both the previous quarter and Q1 2023, with 52 deals and US$8.4 billion in proceeds, up 21% and up a whopping 178%, respectively, YOY. Each of the top seven deals in Q1 2024 raised over US$500 million, versus just one in Q1 2023.

The US, after experiencing a 20-year low in proceeds in 2022, has finally witnessed a noticeable recovery in the first quarter of the year, riding on the wave of the market rally from last year.

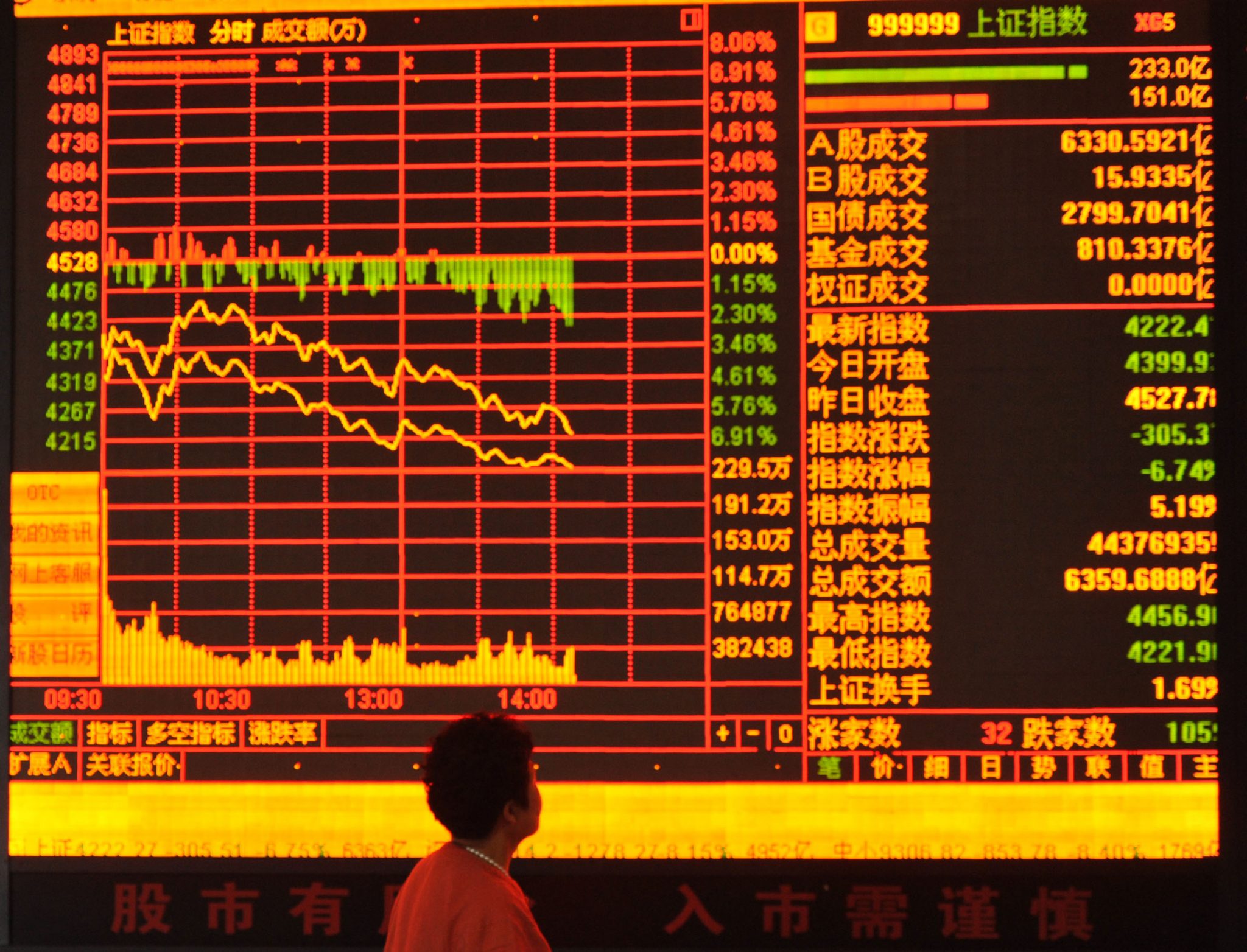

Driven by a subdued IPO market sentiment across the region, Asia-Pacific IPO activity in Q1 recorded 119 deals and US$5.8 billion in proceeds, down 34% and 56% YOY, respectively. This decline was especially sharp in Mainland China and Hong Kong, with the number of deals decreasing more than half and deal size falling by nearly two-thirds.

Both markets have experienced a consistent decline in IPO activity over the past few years. There have been only 10 IPOs so far this year in Hong Kong, with two exceeding US$100m in deal size, marking a historic low since 2010 by proceeds. Japan was the only market in Asia-Pacific to see a slight increase in deal count in the first quarter, with the Nikkei Index hitting an all-time high in February.

Across Southeast Asia, IPO activity was similarly lukewarm, with a total of 38 deals raising US$1.0b, down from 51 deals raising US$1.4b in Q1 2023. Exchanges in Southeast Asia that were most active in Q1 2024 were Indonesia (20 IPOs raising US$224 million), Malaysia (nine IPOs raising US$279 million) and Thailand (six IPOs raising US$273m).

During the quarter, the Philippines, Singapore and Sri Lanka each saw 1 IPO on their exchanges, raising US$202 million, US$20 million and US$2 million respectively.

Chan Yew Kiang, EY Asean and Singapore IPO Leader, said: “The IPO market in Southeast Asia was subdued as high interest rates and inflationary pressures continued to impact the confidence levels of both investors and issuers.

“This challenging economic environment has prompted companies in the region to recalibrate their strategies, placing a heightened emphasis on achieving profitability. As inflationary pressures begin to subside, the anticipated reduction in interest rates is likely to create a more favorable climate for IPOs.

“A strong performance from the global IPO markets will encourage Southeast Asian companies that have been hesitant to go public to re-evaluate their position.”

The EMEIA IPO market witnessed an impressive growth at the start of the year, launching 116 IPOs totaling US$9.5 billion in the first quarter, up 40% and 58% YOY, respectively.

This surge was attributed to larger average deal sizes from IPOs in Europe and India, which enabled EMEIA to maintain first place in global IPO market share by proceeds since Q4 2023. Since 2019, India has rapidly gained prominence, particularly in the number of IPOs, and has now emerged as a standout performer.