After five years of disrupting the recurring payments sector in Malaysia, local fintech Curlec – having been acquired by Indian Fintech Unicorn Razorpay last year – has transitioned from a dedicated recurring payments solution to a full stack payment gateway for businesses of all sizes.

Curlec by Razorpay combines India’s world-class tech capabilities with a deep local understanding of the Malaysian payments ecosystem. It aims to provide businesses with a payment gateway that accepts payments, automates payouts, and helps them focus on their customers.

By harnessing the Razorpay technology that powers 10 million businesses in India, the Curlec Payment Gateway promises to offer an uncompromised payment experience to Malaysian merchants.

The Curlec Payment Gateway will serve more than 5,000 businesses with a target of RM10 billion in annualised Gross Transaction Value (GTV) by 2025. The growth is driven by Malaysia’s fast-growing digital economy (projected to be worth US$35 billion in gross merchandising Value by 2025), high mobile- phone penetration rate, and strong government support for the digital economy.

Malaysia’s real-time payments system, also known as DuitNow, is another key catalyst for merchant acceptance of cashless payments and has significantly aided the emergence of mobile transactions.

Given the fast-growing economies of Malaysia and the broader Southeast Asia region, the scope and need for more robust, reliable, and advanced payment solutions is undeniable.

Commenting on the first international launch of its payment gateway, Shashank Kumar, managing director & co-founder, Razorpay said, “We see great potential in the Southeast Asian market and are delighted to announce the launch of our first international payment gateway in Malaysia.

“We recognise the power of payments in Malaysia and what it means for businesses of all sizes, regardless of sector. Our extensive experience operating in India’s diverse and dynamic market has prepared us to pursue growth on a global scale.

“When we joined forces with Curlec a year ago, our vision was to build products that cater to the needs of Southeast Asian users. The unveiling of the new Curlec Payment Gateway today is a first step in that direction.“

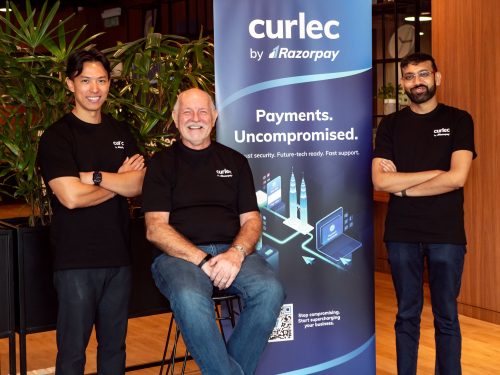

Zac Liew, co-founder & CEO of Curlec by Razorpay said, “We are very excited about bringing a first- of-its-kind offering to Malaysian businesses. With the launch of the Curlec Payment Gateway, we are now a full-stack payment solutions provider, having combined the expertise of both Curlec and Razorpay India.

“We hope to build on our recent significant traction, notably in insurance, lending, and savings, where we tracked a 110% increase in transaction volumes. With Curlec providing an unrivalled payment experience for our customers, we are targeting 10X growth by 2025.

“Driven by the goal of simplifying payments for Malaysian startups and enterprises, Curlec will continue to build a stronger focus on customer needs, and the new payment gateway will help Malaysian businesses scale seamlessly with industry-first solutions and uncompromised support.”

Curlec by Razorpay is trusted by over 700 businesses ranging from SMEs to enterprises and has improved payments for some of Malaysia’s biggest brands including Tune Protect, CTOS, Courts, Mary Kay, and The National Kidney Foundation.